In the final days of January, the stock market erupted and Chapman students and faculty were among those that grappled with and invested in the chaos that started in a Reddit chat room, of all places.

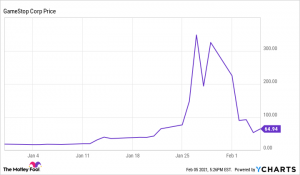

GameStop, the video game retailer that’s as old as dirt and so ten years ago, found itself at the epicenter of this chaos, and they put on quite a show.

“It’s always fun to watch people shoot themselves in the foot,” said Scott Anderson, the notorious accounting professor in Chapman’s Argyros School of Business and Economics.

Colette Cote, a junior in the business school and an analyst in Chapman’s Janes Financial Center gave a simple solution: “don’t get emotional.”

Cote is a prodigal student of Fadel Lawandy, the director of the Janes Financial Center and an associate professor of finance at Chapman.

“All bad decisions in investing come from two emotions: fear and greed” Lawandy said.

Seems Cote learned a thing or two.

Lawandy went on to explain that real investing is based on fundamentals and “you don’t push GameStop to $300 a share on fundamentals.”

Mayhem was born from a customary practice of the stock market known as short selling. Wealthy investors that participate in short selling a stock can borrow a stock and sell it, then buy that stock back later, betting that it will decrease in price, allowing them to pocket the profit. Large investors were short selling GameStop.

Enter the angry Reddit mob of everyday investors.

One after another, Reddit users mobilized and bought shares of GameStop, skyrocketing the price of the stock and forcing the investors that bet it would fall to buy it back as quickly as possible in order to minimize their losses.

The higher the stock price rose, the more money the large investors lost. The Reddit mob was throwing their middle finger up to big investors. Proudly.

Anderson described the events as those similar to a hot table in a Vegas casino.

Brandon Ah Tye, a Reddit user and a junior in the business school, was among those that purchased shares of GameStop.

“Short selling a stock and betting against an American company feels… un-American to me” Ah Tye said.

Ah Tye uses Robinhood as his trading platform and purchased his shares of GameStop through Robinhood just before they banned all of their traders from purchasing shares of the stock.

Enter the angry mob of Robinhood traders.

Ah Tye is one of many Robinhood investors who is looking to transfer his securities to another trading platform.

“From the perspective of the individual investor, shutting down trading on these really volatile stocks is really harmful and it totally goes against what Robinhood was advertising as their mission statement” Ah Tye said.

If you ask Cote, she might say otherwise.

“I think it is more logistical than we think, I think it’s about bandwidth,” Cote said in reference to Robinhood’s trading cap.

Robinhood has since faced nearly 50 class-action lawsuits from their traders, and counting. Yikes.

GameStop has since come back down to earth and as of early March, was trading at around $120 per share, though there have been several more spikes in the stock’s price since then.

So did their big plan work?

Anderson summarized it simply: “We happen to be in the middle of a global pandemic and a lot of people with time on their hands thought that they could outsmart Wall Street.”

Mia Fowler is a senior studying business and journalism. When she’s not in the classroom, you can find her on the soccer field where she is finishing up her last season with The Panthers.

Mia Fowler is a senior studying business and journalism. When she's not in the classroom, you can find her on the soccer field where she is finishing up her last season with The Panthers.